A W-2 form for a former employee refers to the wage and tax statement that employers must send to all their employees, including those who have left the company within the tax year. This form reports the employee’s annual wages and the amount of taxes withheld from their paycheck. Employers are required to send the W-2 form to each employee by January 31st of the following year, so the employees can use this form to file their federal and state taxes.

For former employees, the process is the same as for current employees. The employer sends the W-2 to the last known address of the former employee. If a former employee does not receive their W-2 due to a change in address or any other reason, they should contact their former employer to request a copy. If they still cannot obtain the form, they can contact the IRS for assistance.

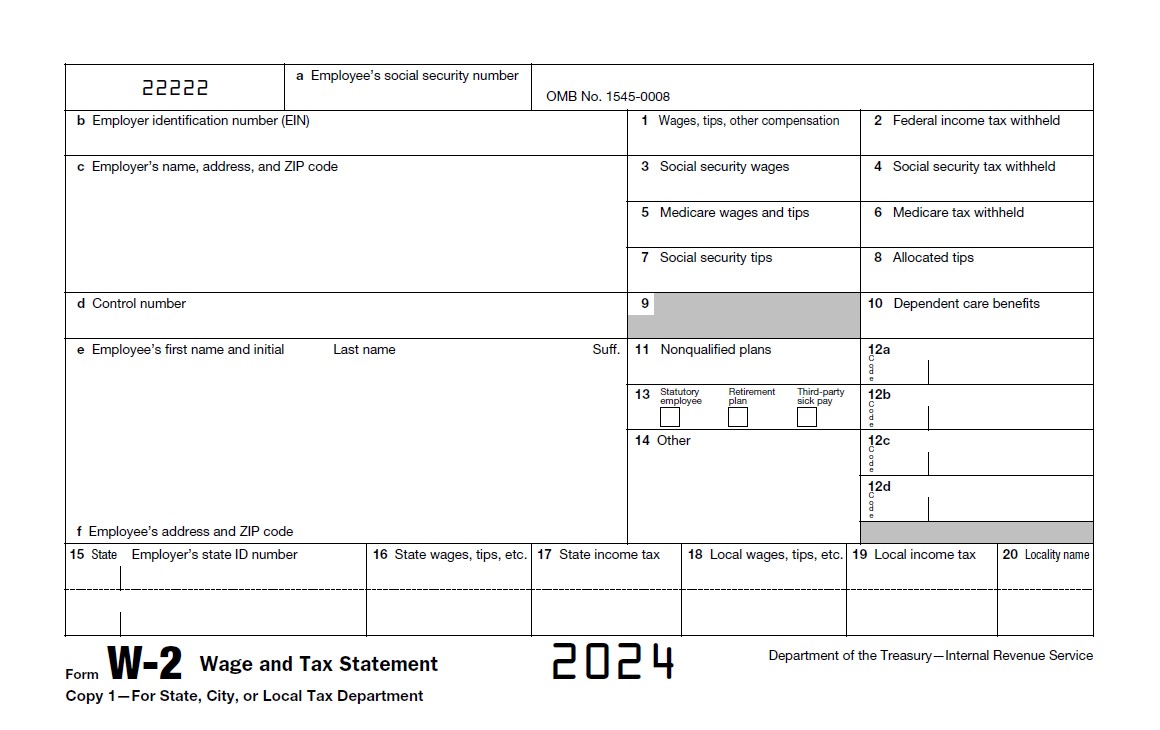

What is W-2 Form?

A W-2 form, officially known as the Wage and Tax Statement, is a document that employers in the United States are required to provide to their employees. It reports an employee’s annual wages and the amount of taxes withheld from their paycheck. The W-2 form includes information such as:

- Employee’s total earnings for the year

- Federal income tax withheld

- Social Security wages and tax withheld

- Medicare wages and tax withheld

- State and local taxes (if applicable)

Employees use the information on the W-2 to file their income tax returns with the IRS. Employers must send out W-2 forms by January 31 of each year for the previous tax year.

Why do Former Employees Still Receive W-2?

Former employees still receive W-2 forms because these forms report the earnings and taxes withheld for any part of the tax year in which they were employed by the company. Here are the main reasons why a former employee would receive a W-2:

- Earnings from the Tax Year: The W-2 form reflects the compensation received during the tax year, regardless of whether the individual is still employed at the year’s end. If a person worked at any point during the tax year for a company, that company is required to provide a W-2 form to account for the employee’s earnings and the taxes withheld during their period of employment.

- Tax Obligations: The information on the W-2 form is essential for former employees to fulfill their tax obligations. It includes the total income earned, as well as federal, state, and other taxes withheld, which are necessary for accurately completing tax returns.

- Social Security and Medicare Contributions: The W-2 also reports the contributions made to Social Security and Medicare. This information helps ensure that former employees receive proper credit towards their future benefits.

- Legal Requirement: Employers are legally required to send W-2 forms to all employees who earned wages during the tax year, including those who have left the company. This ensures that all parties meet their tax reporting obligations under U.S. tax law.

These points underscore the importance of W-2 forms in ensuring both former employees and employers comply with tax laws and accurately report income and deductions.

How to Get an Old W-2 From an Employer?

Getting an old W-2 form from a former employer can be necessary for a variety of reasons, such as filing back taxes or clarifying your tax records. Here are the steps you can follow to retrieve an old W-2 form:

1. Contact Your Former Employer

Reach out to the Human Resources or Payroll department of your former employer. Provide them with your full name, the last four digits of your Social Security number, and the tax year(s) for the W-2 you need. Request that they send you a copy of your W-2. Some employers might have digital portals where past employees can access their tax documents.

2. Check Your Old Email or Postal Addresses

Sometimes, W-2 forms might still be sent to your old email or postal address, especially if you did not update your contact details with your former employer. Check any old addresses or email accounts where the document might have been sent.

3. Contact Your Tax Preparer:

If you used a tax professional or service to file your taxes in the year you need the W-2 for, they might still have a copy on file.

4. Use the IRS

If you can’t get your W-2 from your employer or if the company is no longer in business, you can order a copy of your wage and income transcript from the IRS that shows data from your W-2 by using IRS Form 4506-T. This transcript will have the federal tax information your employer reported to the IRS.

For an actual copy of your W-2, you’ll need to complete IRS Form 4506, Request for Copy of Tax Return, and mail it to the IRS along with the required fee. However, note that the IRS only retains actual copies of Form W-2 for seven years.

5. Check with State Tax Department

If you’re still having trouble, you can also contact the tax department of the state in which you were employed. Some states require copies of W-2 forms to be submitted by employers and may be able to provide you with a copy.

Using these steps, you should be able to obtain a copy of an old W-2. Remember, it’s important to keep your contact information up to date with past employers and the IRS to avoid these issues in the future.